Tomorrow, the San Francisco Board of Supervisors is going to vote on whether or not to urge the city’s retirement board to divest over half a billion dollars from the fossil fuel industry. This is a landmark resolution to divest the city’s pension fund — one of the largest pools of money the city holds — from the top 200 fossil fuel companies, and would be by far the largest commitment to divestment by a city to date.

The bad news is that this is going to be a very close call, as divesting 8.7% of holdings in its Employee’s Retirement System is a big deal, even for a city government known for its pioneering spirit and progressive values.

The good news is that if you are a San Francisco resident you can send a quick message to the Board of Supervisors today to make your voice heard in support of divestment. They do read them and numbers matter, especially to supervisors that might be on the fence about this.

This is where the action will be tomorrow morning, and I know that Bill, Jamie and the rest of the 350.org gang will be watching closely. If you’re not a SF resident writing a letter you can still send some big love and abracadabra vibes towards this place mañana…

Below, some more thoughts and pics from the hearing a couple of weeks ago when Supervisor John Avalos introduced the resolution that urges the retirement board to divest from fossil fuels and reinvest in sustainable alternatives: clean energy, local energy retrofits, and more.

Remember, it’s San Francisco, anything can happen!

On April 10 hearing, Supervisor Avalos introduced the Resolution urging the Retirement Board of the Employees’ Retirement System to divest from publicly-traded fossil fuel companies (file #130123):

The San Francisco Employee’s Retirement System should immediately freeze any new investments in fossil fuels, and divest from direct ownership and any commingled funds that include fossil fuel public equities and corporate bonds within 5 years.

Over 50 students, doctors, indigenous leaders, investment advisors, environmentalists, and everyday San Francisco residents turned out for this budget committee hearing to push for divestment.

Room 244 at City Hall was packed and sizzling, something you don’t see to often at ordinary hearings. In fact, there was a bunch of city business on the agenda, but when Supervisor Avalos at one point asked who was there for the divestment introduction, every single person in the room raised their hand.

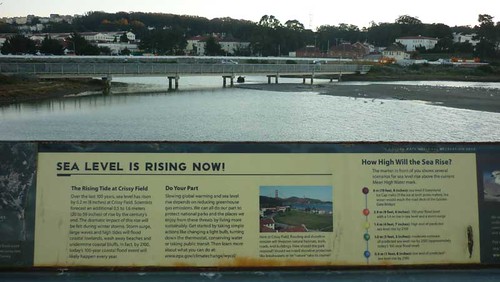

Supervisor Avalos, a very smart and eloquent representative who understands the deeper causes and ramifications of climate change, made the case not only that as a coastal city San Francisco is extremely vulnerable to rising sea-levels costing billions of dollars in infrastructure and property damages, but that the city who prides itself in being visionary and bold has a moral obligation to be an early adopter of the divestment strategy, making it easier for others to follow. Avalos also mentioned the divestment campaigns of tobacco and Apartheid in the 90s as examples of successful campaigns that nobody thought possible at the time.

Next up was Jamie Henn of 350.org, one of the official experts testifying, making a strong moral argument for divestment as well as a tight financial case.

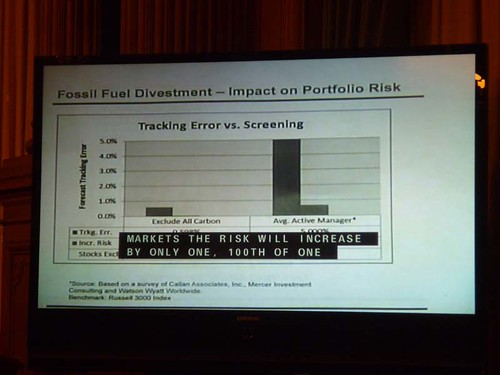

Investment advisors from the Aperio Group explained how divestment would increase portfolio risk by such an insignificant amount that it was basically just background noise. Garvin Jabusch from Green Alpha Advisors showed the benefits of investing in a green economy. Aside from the fact that it is morally wrong to profit from wrecking the planet, a key argument was that investing in fossil fuel companies is investing backwards, as their portfolios will inevitably become less valuable once carbon emissions become more strictly regulated and their true cost apparent. Jabusch pointed out that fossil fuel portfolios might become so risky in the future that they will become subprime assets.

Jay Huish, Executive Director of the San Francisco Employees’ Retirement System, gave a rundown of the total fossil fuel holdings in the city’s current retirement plan. He said that the city is currently invested in 81 out of the Top 200 fossil fuel companies, constituting $528 million of the city’s $8.6 billion in public holdings, or $8.7. He didn’t want to answer Supervisor Avalos’ question as to how quickly those $528 million could be divested, but indicated that they would and could do it if the city gave that mandate.

Then it was time for the public to step to the mic, and boy, did they ever.

Rebecca Solnit, SF native and author extraordinaire, warned about the instability represented by fossil fuels and pointed out the importance of getting on the right side of history early. She thought a miracle was possible, but only if we are courageous enough to break our bad habits.

Person after person stepped up to the podium, urging their city to show the same early adopter courage and moral compass on divestment that it demonstrated on gay marriage or zero waste. It was really quite heartening, and in the end Supervisor Avalos skillfully maneuvered around a much more skeptical Supervisor Mark Farrell to bring the resolution before the full Board of Supervisors. And that day is tomorrow.

As Jamie Henn writes:

This new divestment movement is already making a big impact: over 300 colleges and universities have joined the campaign and more than 100 cities and towns are now running local petitions. Getting San Francisco to move towards divestment would be a game-changer, but it’s only going to happen if we all pitch in.

If you’re in SF, please send a letter to the Supervisors today!

The planet thanks you!

o~O~o~O~o~O~o~O~o~O~o

[…] San Francisco Board of Supervisors to Vote Tomorrow on Divesting $500 million from Fossil Fuels (svenworld.com) […]